By Dimitris Delevegos

The good climate and the lower prices of real estate on the Greek islands, compared to competitive destinations across Europe, have skyrocketed the interest of foreign investors in Greek holiday homes.

The large “pool” of buyers includes affluent pensioners looking for a second home by the sea and investors looking for returns or seeking to obtain, through the “golden visa” regime, a residence permit. Greek buyers are a minority.

For these reasons, which have as a common denominator the explosive rise of Greece as a destination for holidays, but also for working remotely, an unprecedented movement has been recorded in recent years in the top holiday places of the country.

“We have never seen so much enthusiasm for the South Aegean before. In 2021, prices increased by about 10%. Islands that once remained out of interest are now in demand. For many, Greece is synonymous with stability in the midst of global destabilization. We therefore estimate that the demand and prices of houses in the South Aegean will increase further this year,” notes the CEO of the Engel & Völkers Greece network, George Petras.

“The interest in real estate in Mykonos, Paros, Crete, the Peloponnese, but also in Athens, is particularly strong from America, due of course to the fact that our company has, there, a long-term presence. Also, in Northern Greece, serious interest comes from Germany, Sweden and Bulgaria,” comments the director of the digital real estate network exp Realty, which counts a few months of presence in the Greek market, Nikos Manomenidis.

It is estimated that in the islands of the South Aegean, which attract the highest investment interest, compared to 2019, buying and selling increased by 80%, while demand, recorded through requests in the real estate networks, increased by 200%.

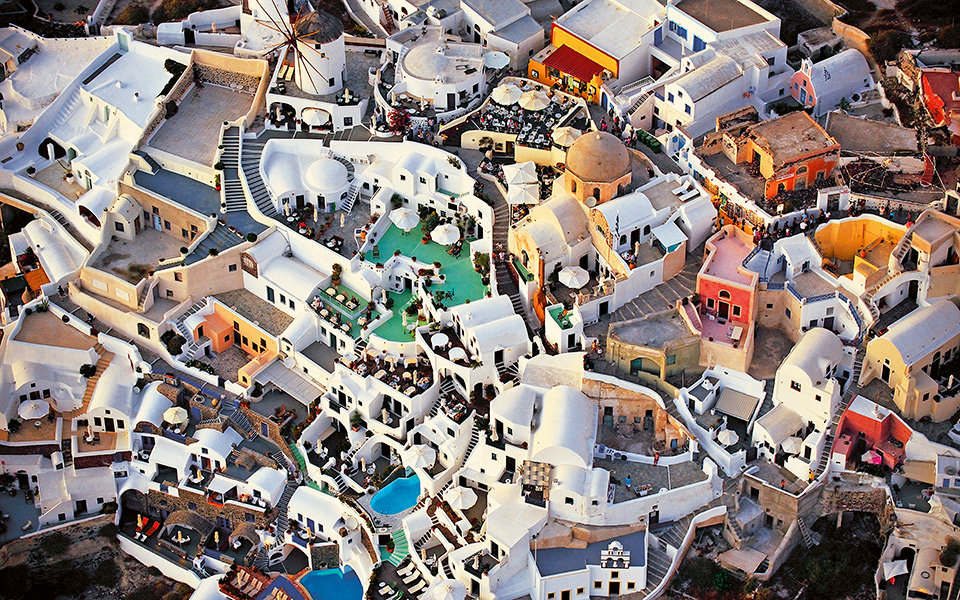

© Giannis Giannelos

Top destinations

According to Engel & Völkers, which has mapped the holiday home market, the ten islands of the South Aegean that attract the highest demand are Mykonos, Rhodes, Paros, Syros, Symi, Santorini, Patmos, Naxos, Andros and Tinos.

On the “Island of the Winds,” one of the most expensive villas located near Agrari sold in the last twelve months by Engel & Völkers, for a price of 3.85 million euros, and has an area of 560 square meters. Also, the real estate network sold another villa for 7.5 million euros, at a distance of 5 km from Mykonos Town. The high price of this house may be justified if we take into account that the property, with an area of 540 square meters, has seven bedrooms, an 18-meter swimming pool, a garden and views of the island of Delos.

More broadly, the highest house prices located in good locations, which realtors refer to as “exclusive” properties, are located in Mykonos and Paros, and range, on average, from 2 to 5 million and from 1.5 to 3.5 million euros respectively.

In Rhodes, the asking prices for the sale of high quality seaside houses are from 1 to 2.5 million euros. Although these prices seem astronomical, when compared to those for high-end residences in other European holiday destinations, they remain competitive, as professionals in the sector insist on reminding us.

The majority of home buyers in the Cyclades and the Dodecanese are foreigners. Almost one in two is German, followed by the Swedes, Austrians and British. Buyers from France, Italy, Spain, the USA, Israel and Greece account for a total of 30% of transactions.

© Perikles Merakos

High yields

According to experts, the returns offered by the holiday home are higher compared to those resulting from the long-term rental of apartments and have intensified investment interest. The return on investment (ROI) for properties rented on most days of the summer season is placed in Mykonos from 5% to 10% and ranges from 4% to 7.5% and from 5% to 8% in Paros and Rhodes respectively.

According to a recent survey by the Re/max real estate network, securing goodwill through short-term rentals or more broadly tourist exploitation seriously affects the decision to buy a holiday home, as found by seven out of ten offices of the real estate company. The promised returns of the holiday home are also fueled by the fact that until at least 2016, the asking prices had fallen by up to 50% since the beginning of the economic crisis.

Due to these attractive returns, new players are looking for opportunities in the Greek real estate market, especially after the very large contraction of purchases and sales, through “golden visas,” by the Chinese.

Indicative of this trend is the fact that India, which has a significant number of wealthy citizens, belongs to the markets where not only Greek but also foreign brokers look forward to making deals. “There is a lot of movement from foreign brokers who have a source of interested buyers from India,” emphasizes Mr. Manomenidis. The “bridge” with the Indian market seems to have already been realized thanks to tourism, as this year the interest in Greece and by extension the bookings of Indian tourists have increased significantly.

This article was previously published in Greek at moneyreview.gr.